I don’t need to introduce blockchain to anyone reading this blog as this technology is already much talked about among businesses. We all know that blockchain is gradually changing many industries and business processes for the better.

Finance is one field where researchers predict mass transformation due to blockchain technology. This technology is shifting the ways we manage transactions, systems, and processes in finance. But, this discussion will still be incomplete unless we focus on why there is so much hype about blockchain technology. What are the biggest changes it is expected to bring to finance?

Here are the answers!

Latest Finance Industry Trend - DeFi

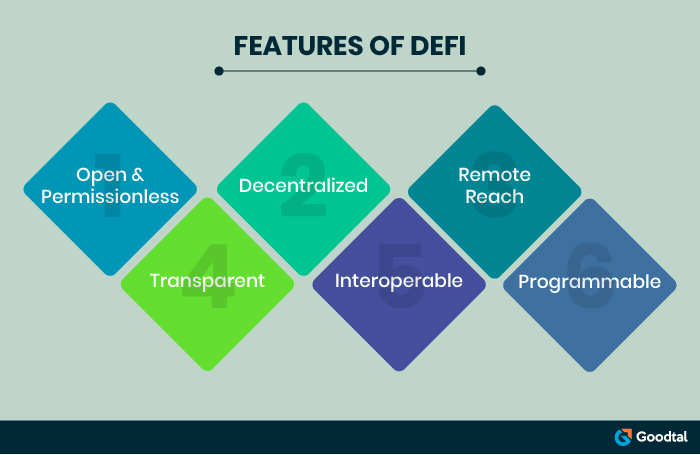

The adoption of blockchain has enabled the emerging trend in finance termed as DeFi, which is the short form of Decentralized Finance. As the term suggests, DeFi offers decentralized, distributed networks without a central authority and spread over a wide range.

Why DeFi?

The financial industry needs to switch over from centralized to decentralized networks for many reasons.

DeFi allows access to financial services even without strong internet connectivity. It is based on public blockchains and thus allows transparency on transactions that can be verified by anyone.

DeFi is secure due to the decentralized and tamper-proof nature of blockchain making it difficult for error-prone participants to tamper with the system. As the intermediaries are absent, DeFi transactions are fast and cost less.

DeFi is highly programmable enabling compliance with auto-executable rules and agreements that can’t be neglected by any unruly participants. Such systems are easy to manage and audit.

The decentralized blockchain networks do not require a central authority to regulate them and can be spread over a wide network. They are composed of immutable ledgers so that once a block is developed in the network, it can’t be changed. They follow consensus-based mechanisms where the network participants are assured that the data is correct and the transaction is verified by all members, increasing trust and verifiability.

DeFi for peer-to-peer finance is often implemented using the Ethereum blockchain.

The benefits of blockchain-based finance are further discussed in detail here.

Benefits of Blockchain in Finance

Security

Security is a serious concern for the finance sector. As we are aware, blockchain offers decentralized, immutable ledgers that can be leveraged in the financial sector. These ledgers are secured with cryptography, so it is almost impossible to hack such systems, leave apart alter the data stored on the system. Thus, banking and other financial processes are increasingly adopting blockchain technology.

Transparency

When we talk about immutability, another feature of blockchain comes into the picture, i.e, transparency. In the financial sector, blockchain technology allows the transacting parties to access information. This reduces the risk of fraud by any participant against others.

Performance

Blockchain is apt for real-time processing of transactions. It also eliminates the need for intermediaries. As a result, adopting blockchain in finance saves a lot of time and costs in dealings demanding real-time processing.

Better Compliance

Blockchain can be perfectly programmed with all the rules and regulations for compliance in the finance industry. It will automatically enforce compliance and reduce complications during the audits.

Accessibility

Blockchain can make financial services accessible to remote areas where there was no or limited access to manual or traditional banking solutions.

Suggested Reading: Applications of Blockchain Technology in 8 Major Industries

How Blockchain Enhances Privacy in Banking

Privacy is a major requirement in the banking sector. It is also one of the crucial reasons of adopting blockchain in banking. Let’s see how blockchain contributes to privacy in banking processes.

Pseudonymity

Transactions in blockchain-based banking are recorded using pseudonyms. This prevents the private information of the users from being leaked, protecting their identity and privacy.

Permissioned Blockchains

Various banking functions require only authorized users to access the information or system. The permission-based blockchain concept allows this by selectively allowing access to the system to authorized entities using smart permission management.

Automatic Management of Information

Blockchain-enabled smart contracts can automate compliance and enforce privacy as they can be programmed to manage sensitive information generated during the transaction. Thus, it is not at the discretion of participants to store, view, or delete sensitive information that they, ideally, should not have access to.

Limitations of Using Blockchain Technology in Finance

It would be biased to believe that blockchain technology has no risks or limitations. Every technology is vulnerable to some challenges which need to be worked on. Blockchain technology is also under regular upgradation to match the changing needs of the industry and users.

Here’s a list of the common blockchain challenges that are blocking the way on large-scale adoption.

Scalability

Blockchain technology so far allows limited scalability in terms of the number of transactions per second. So, systems that need to accommodate more transactions simultaneously can't adopt blockchain as yet. We know that banking and many other financial sectors need such scalability. However, blockchain technology is advancing each day and we expect that this limitation will be covered in the near future.

Integration

Blockchain technology is difficult to integrate into conventional existing systems. Moreover, even if businesses are prepared for the hassles, the process of integration is time-consuming and most financial systems can’t afford any disruption due to such a transition.

Interoperability

There are different types of blockchain platforms and they lack interoperability. So, businesses have to do a lot of research before implementing blockchain across a wide range of services and systems.

Complexity

Blockchain is complex and difficult for non-technical users to understand or adapt. Moreover, even technical users need to learn and understand this technology to be able to leverage it effectively.

Regulation

Blockchain is a comparatively new technology for this banking sector with strict regulatory requirements. Governments across the world will have to incorporate issues related to the use of blockchain technology while making and implementing regulatory policies in banking. This is not a long-term challenge and it will resolve once the systems are in place and blockchain is adopted widely and globally.

How to Strike a Balance Between the Use of Blockchain and Challenges?

Challenges have never been a bottleneck in development for ambitious businesses who believe that the right efforts can help overcome them.

So, here are the ways businesses can strike a balance between the use of blockchain and the challenges.

Hire the Right Blockchain Developers

We all know that no matter how powerful the technology is, it’s useless without effective implementation. So, the first step to developing blockchain-based systems is to look for the right developers. No challenge is big for experienced developers who are willing to experiment.

Train the Users

For any new technology or tools, training the users enables effective implementation. So, most blockchain challenges can be resolved if the users are trained well.

Selectively Integrate

Select the areas where blockchain can be most useful and integrate this technology in such areas initially. With time, as technology advances and we have more experience dealing with it, it can be integrated across the system.

Experiment

Blockchain technology is still new. We can’t say that it is in the nascent stage though. It is undergoing rapid transformation to curb all the limitations associated with it. Businesses will need to experiment more with it and identify the areas that can be worked on.

With more experience and expertise such experiments can lead to better outcomes using this technology. Undoubtedly, finance is not such a sector where you can freely experiment as the consequences can be serious.

Applications of Blockchain in Finance

How can we end a blog about blockchain in finance without discussing how different sectors of the finance industry are leveraging blockchain? The infographic here lists the common use cases of blockchain in finance.

Wrapping Up!

Blockchain technology is revolutionizing the finance industry with its merits such as security, transparency, and efficiency. It helps optimize processes, streamline the systems, reduce costs, increase efficiency, and as a result, increase trust between businesses and users.

Costs and resource limitations are limiting businesses from adopting blockchain wholly into their systems. However, it is not even necessary to adopt blockchain everywhere. Businesses must research and evaluate the needs to identify the areas that can benefit the most from the blockchain.

Technology is useless if not implemented effectively. If we are not blockchain experts, we should hire expert blockchain developers to develop blockchain-based software and apps so that we can derive better-than-expected outcomes. As you know, you have the opportunity to find the best blockchain developers from Goodtal lists.