Blockchain is a shared, immutable ledger that makes it easy to record transactions and track assets in a business network. Immutable means that it cannot be changed and remains fixed.

The asset can be a house, car, cash, land, intellectual property, patents, copyrights, branding, etc.

Blockchain will create a trusted, uncensorable, unfilterable data repository, which will be accessible worldwide. It is these characteristics that will make it invaluable to the insurance industry.

In this blog, let's look at how blockchain can revolutionize the insurance industry.

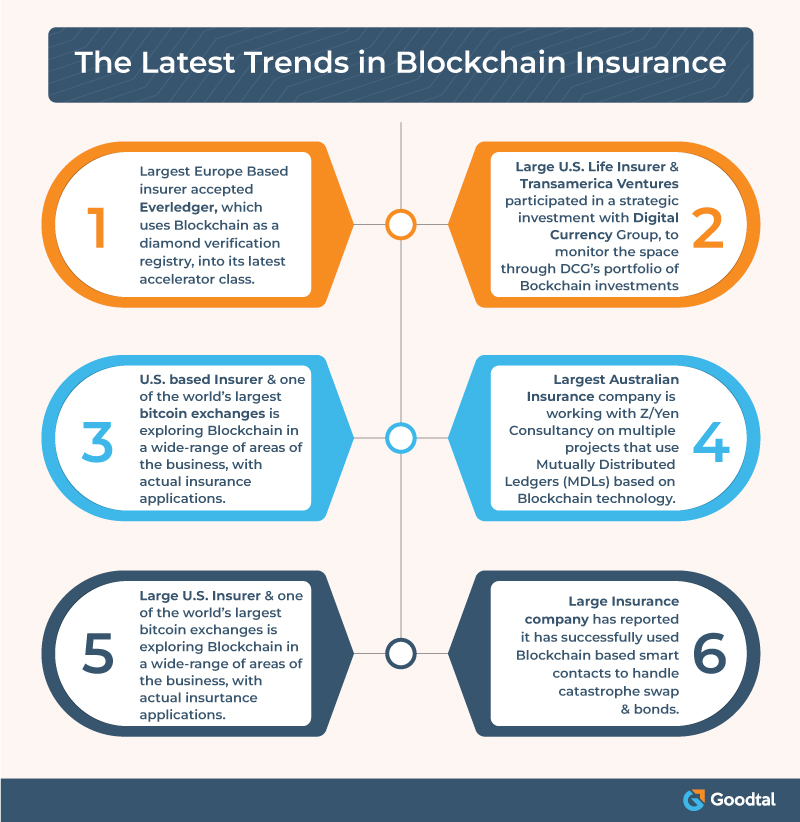

The Latest Trends in Blockchain Insurance

(Source: Wipro)

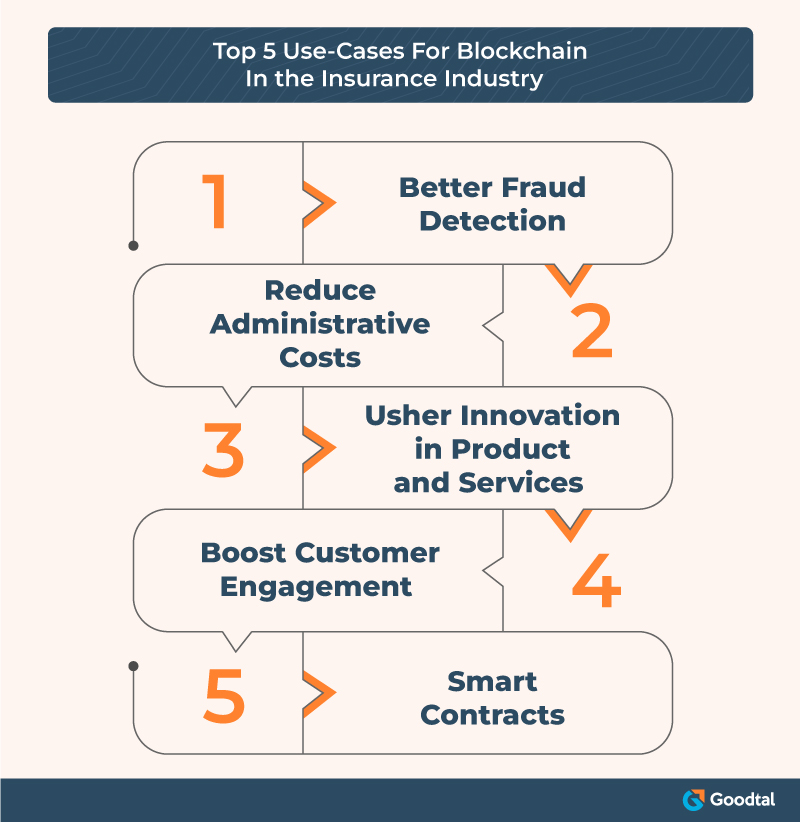

Top 5 Use-Cases For Blockchain In the Insurance Industry

Blockchain has the potential to change the inner workings of Insurance companies. Here is how it can do it:

Better Fraud Detection

Blockchain can assist in detecting identity fraud, falsified injury, damage reports, etc.

As per the FBI report, an estimated five to ten percent of all insurance claims are fraudulent. It costs US non-health insurers more than USD 40 billion per year. Blockchain can help:

- Confirm ownership and record of goods and verify documents like medical reports.

- Check for police theft reports/claims history and a person's verified identity. It can also detect patterns of fraudulent behavior related to a specific identity.

- Prove data and time of policy issuance or sale of asset/product.

- Confirm ownership and location changes.

All this requires cooperation between insurers, manufacturers, and customers. Without proper collaboration, it's impossible to reap blockchain's full benefits.

Blockverify is a startup in fraud detection for electronics, pharmaceuticals, and luxury items. It can help detect counterfeit products, stolen goods, and fraudulent transactions.

Blockverify labels products and store's their history and supply chain in the blockchain. Another excellent application is Everledger for the verification of diamonds and related transactions.

Reduce Administrative Costs

Blockchain can automatically verify policyholders' identity and contract validity. It will give reinsurers controlled access to claims registered on the blockchain for better transparency in an automated and auditable way.

Blockchain can also register claims and data from third parties, like encrypted patient data between doctor and injured party, which will be accessible by the insurer to verify the payment.

The payouts for all claims can get done through a blockchain-based payments system or smart contracts. All this will significantly reduce administrative costs.

Usher Innovation In Products and Services

Blockchain will offer a shared and reliable platform for customer-controlled personal data, peer-to-peer (P2P) insurances, and smart contracts.

Customers fear losing control over their data when it is handed over to a company. Also, it feels frustrating for them to go through data entry processes repeatedly. These problems can get addressed by a customer-controlled blockchain for identity verification or medical/health data.

Personal data does not need to get stored on the blockchain and will remain on the consumer's device. Only its verification is registered on the blockchain. Here, scalability is essential to take advantage of blockchain as it needs a sufficient number of parties to reuse the verified data.

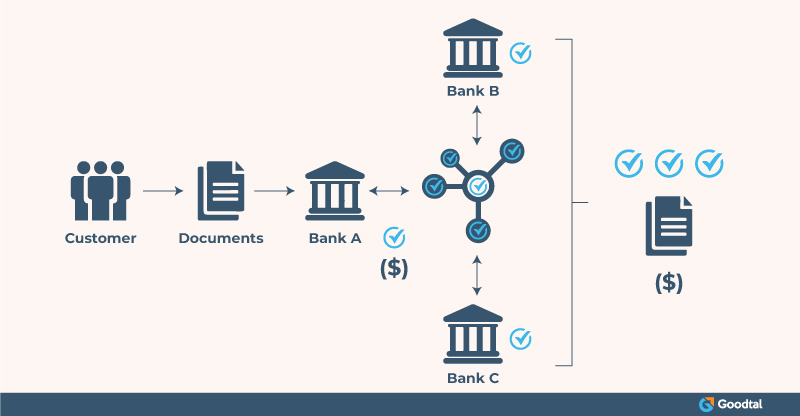

Tradle, a start-up company, is working on blockchain solutions for know-your-customer (KYC) data. KYC allows the customer to grant a company their identity data for a contract closure.

(Source: Merehead)

After the KYC profile is verified, a user can forward the identity data to other companies for different contracts with the same tool, eliminating the need to repeat the entire process.

So, it speeds up the entire process and makes it more efficient to acquire new customers.

Better Customer Engagement

Blockchain can improve customer engagement by establishing transparent and fair tariffs and claims handling.

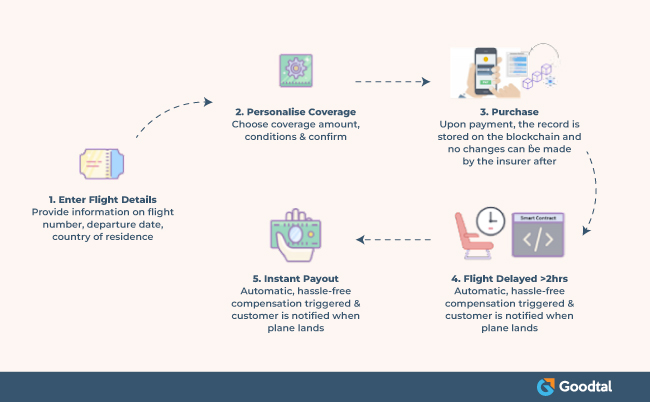

InsureETH, a startup, presented a P2P flight insurance policy built on blockchain and smart contracts. These contracts initiate payouts for insured flight tickets when delays or cancellations are reported from verified flight data sources.

(Source: The Digital Insurer)

Although the P2P insurance business model is already being offered through standard technology, blockchain makes it more transparent and trustworthy for customers as no one controls its operation. So, it allows a provider to automate P2P insurance operations.

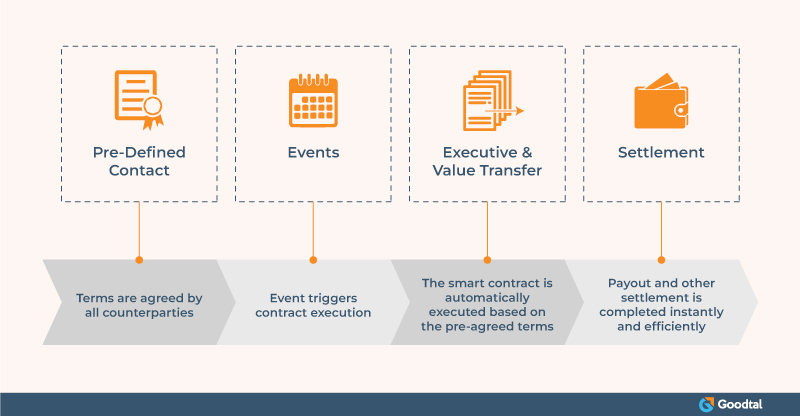

Smart Contracts

Smart contracts allow automation of claims handling. They are a transparent and reliable payout mechanism for the customer and can get used in enforcing contract-specific rules.

Here is an example: Let's say there is a car accident. A smart contract will ensure that the claim is only paid out if the car is repaired in a garage preferred and predefined by the insurer.

Smart contracts provide better customer transparency and credibility due to decentralization and automation of transaction verification and reconciliation. Also, it offers significant network effects as several parties using it would not be willing to do the same with a centralized platform or, in the case of P2P insurance.

(Source: Intellias)

Dynamis is a blockchain start-up working on smart contracts for insurance products. The company is developing P2P supplemental unemployment insurance and utilizes social network profile data to verify the employer's status. Here, the smart contracts are automating the underwriting of policies and claims handling, combined with approvals/verifications from other policyholders serving the evaluators' role.

Insurance companies should understand customer needs and pain points in-depth to determine where they can implement blockchain use cases.

If you are looking to get into Blockchain, then check out Goodtal. It provides a list of top blockchain developers you can hire to implement blockchain technology into your business.

With affordable rates, streamlined workflow, and end-to-end services, Goodtal is the perfect go-to for blockchain solutions.

For Further Reading

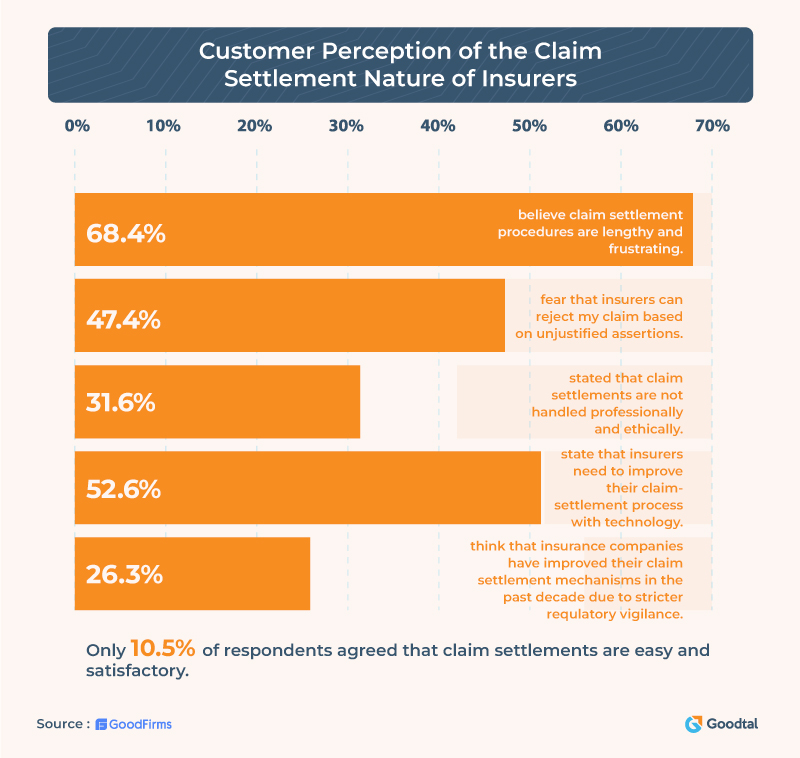

Blockchain isn't the only technology that will empower the insurance world. There is telematics for insurance premium adjustments, Metaverse, AI, and robotics for automating processes. To know more about these, check out Goodfirms research on Global Insurance Industry. You will learn about the insurance industry's key challenges, trends, and current scenarios.